Investment case

We offer exposure to a sizeable market with potential for further organic expansion and consolidation.

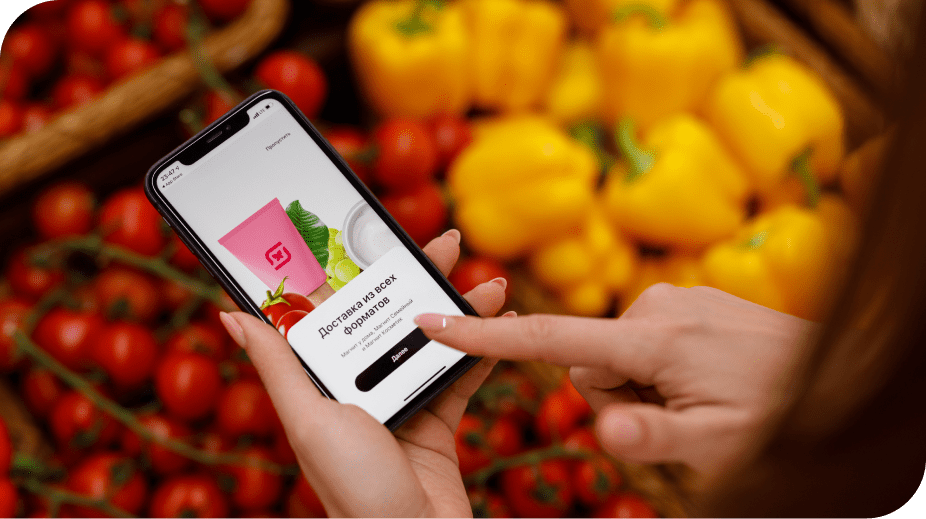

Magnit is one of the largest food retailers in Russia with well-developed infrastructure, strong customer base, a recognisable brand, and a growing market share.

- Multiformat offering with four core formats covering a range of shopping missions in grocery, drogerie and pharma segments

Food

Drogerie

Pharma

- Wide coverage:

27,405

stores 4,068

cities and townships 7

federal districts 12.8 %

market share in food retail sales 67

regions of operation 68 mln

loyalty card holders Serving customers in all highly populated Russian regions

- Well-developed supply chain

44

distribution centres and one of the largest own truck fleets in Russia - The only vertically integrated retailer in Russia

20

own production facilities and agricultural complexes On track to speed up profitable return-driven growth leading to further market share gains.

+5.3 %

selling space YoY growth in 2022 +9 %

in-house produce YoY growth in 2022

We have great potential for further business development.

Strong capital discipline with a focus on returns in all investment decisions with a view to generating substantial dividend payments.

2.1x

leverage (IFRS 16) as at 31 December 2022